Designing a sales commission plan for SaaS sales representatives presents a unique challenge. Recurring revenue payment models are different from traditional sales commission structures. Implementing the right pay mix strategy is crucial for setting a commission plan that works for the business and its sales reps.

Setting up sales compensation plans for your sales teams can be a challenging prospect for SaaS executives. The goal for any sales compensation plan is to create an alignment between business objectives and your sales reps.

The best sales compensation plan examples motivate sales reps to achieve aims that are mutually beneficial for them and your business. However, the needs of a SaaS business are slightly different from other organizations, due to the overwhelming popularity of recurring revenue or subscription payment models.

This article will explore why these models are used by SaaS businesses and what they mean for your compensation plans.

But first, let's define some key terms and concepts relating to SaaS sales commission plans.

What is a commission plan for recurring revenue?

A commission plan is a way to provide a monetary incentive for your sales representatives. Typically, these incentives (or commissions) are a percentage of the rep's sales. However, recurring revenue business models require a different approach.

It's very straightforward to build a commission plan for one-off purchases. But most developers don't sell software this way anymore. Instead, over the last decade, we've seen the rise of subscription payment models.

What is a SaaS subscription model?

A Software-as-a-Service (SaaS) business model is a revenue plan where businesses sell cloud-based software on a subscription or pay-per-use basis.

In the past, software developers used to sell licenses for their products. Generally, businesses would buy a one-off license that allowed them to use the product indefinitely. Support, maintenance, updates, etc, were an additional element of their service.

These programs were installed and stored on-premises. However, the rise of broadband internet and cloud storage changed everything. A business could host their software on their own servers and lease use to their clients.

There are a lot of advantages to cloud-based SaaS services.

For businesses, SaaS business models allow:

-

Predictable revenues

-

Easy scalability

-

Simple to update

For consumers, SaaS services allow:

-

Remote access

-

Enhanced security

-

Savings on server fees

How prevalent are SaaS applications?

As reported by McKinsey, SaaS has become the default software-delivery model. In 2010, SaaS accounted for around 6% of enterprise software revenues.

By 2018, that number had grown to 29%. However, when you account for software developers who are moving into subscription models, that number is closer to 75%.

Similarly, a report from Gartner in 2021 suggested further aggressive growth for cloud-based software. They suggest that public spending on SaaS services will be around $176m in 2022 and over $200m by 2023.

To give you a better idea of how popular SaaS applications have become:

Why SaaS needs a different commission plan

SaaS vendors charge clients for access to a product or service in exchange for a regular fee. For example, charges could be monthly, quarterly, or annually.

In fact, revenue generation measures like MRR (monthly recurring revenue) and ARR (annual recurring revenue) play a huge role in how modern startups are valued.

However, when it comes to building a commission plan, this poses an issue. While some SaaS subscription models have contracts, they are overwhelmingly charged on a month-by-month basis. And it is this uncertainty that causes an issue for any organization designing a sales compensation plan.

Onboarding a buyer for your SaaS solution doesn't guarantee revenue beyond a monthly, a quarter, or a year timeframe. The majority of SaaS agreements operate on a rolling month basis. Signing up a customer is one thing, but what if they leave after one or two months?

So, how can you calculate an appropriate sales commission when you don't know the value of the business your sales rep has brought in?

Herein lies the issue.

The importance of sales commission and sales compensation plans

Competitive sales commissions and sales compensation plans are an essential way to attract and retain top sales performers. Employee churn costs time, money, and productivity.

A solid commission plan is an excellent way to show your sales reps that you value their sales efforts. Additionally, it will encourage sales reps to work as hard as they can.

We've already addressed the importance of a good pay mix. Establishing the right balance between base pay and sales commission depends on several different factors.

Having a decent base salary is a good idea because it reflects the fact that sales reps spend a good amount of their time on prospecting, traveling, and administration.

Sales commissions are a powerful way to motivate reps and sales teams. They make your organization attractive to top sales talent and help you drive revenue.

If your sales reps earn money, then you do too. A solid commission plan is good for both the company and your sales representatives.

Elements of a commission plan

Your commission plan will likely be made up of a few different components. We have already discussed the importance of finding the right pay mix strategy. But, your compensation plan structure can be split into a number of different parts.

Base salary

Base pay is a fixed monthly or yearly salary a sales rep receives. It's the salary that your employees get before they reach their sales targets. Not every organization offers their reps base salary, preferring to pay them in commissions only.

Variable pay

Variable pay — or commission — is the sales related extra pay a rep gets on top of their salary. The standard commission rate for a SaaS sales is around 10%. For example, if a rep closes a deal worth $10,000, they will receive $1000.

ON target earnings

On target earnings (OTE) are the earnings that salespeople receive when they clear their sales quota. Commonly, OTEs are split evenly between base pay and variable pay. For example, $50,000 base salary and $50,000 variable pay based on meeting pre-defined sales targets.

BOnus

Of course, the best sales reps will often beat their quota. Bonuses offer reps incentive for reaching specific milestones. Sales organizations can set bonuses as a percentage or as a fixed-monetary amount.

Non-cash rewards

Just like many modern compensation packages, money isn't the only reward that drives sales reps. Many SaaS business also offer non-cash rewards to their best performers. These incentives can be sales awards, vouchers, holidays, or anything you imagine.

If you are considering using non-cash rewards as a way to motivate your staff, ensure the rewards are something that they will consider useful.

Now that we've covered the key concepts around commission plans and subscription models, it's time to get into the challenges of calculating SaaS sales commission structures.

SaaS Sales Commission Challenges

By the end of this article, you should understand three key sales compensation management skills. We want you to:

-

Have a solid grasp of the two fundamental design challenges that need to be addressed when you design a sales compensation payment plan for recurring revenue businesses

-

Become familiar with the different types of design options at your disposal to address those challenges

-

Be able to assess what works, and what doesn’t, and know what’s important to meet your business objectives.

Design challenge #1 for sales commission structures

The first design challenge you must overcome when you are designing a sales compensation plan for a recurring revenue (RR) model is figuring out how to measure the value of a sale.

You see, SaaS sales are recurring, but they aren't always consistent. For example:

-

A pay-per-use charge depends on the frequency of use

-

A subscription can go up and down depending on the number of users or your client's growth.

Let's run a scenario.

You sell SaaS analytics software for health care. In January, one of your sales reps announces that he's managed to close a deal with a plucky young tech startup that is developing a drug for Parkinson's disease. They buy 10 subscriptions @ $100 each.

In February, the startup goes through a successful funding round. They announced plans to expand their workforce, and before March, they have 100 subscriptions.

Things are going well, and they recruit more employees over the summer, bumping their subscriptions up to 150.

However, in September, a competitor beats them to the punch. Their product has a first-mover advantage, and it's better.

Approaching the end of the year, they've burned their runway, and now they are struggling to get new investors.

In a bid to save the company, the founder slashes staff and costs. By November, they have 15 active subscribers. However, the founder is convinced they can turn the ship around and secure VC funding early next year and come back bigger than ever.

So, let's work out what revenue they generated.

January: 10 subscriptions @ $100 = $1000

February: 100 subscriptions @$100 = $1000

March: 100 subscriptions @$100 = $1000

April: 100 subscriptions @$100 = $1000

May: 100 subscriptions @$100 = $1000

June: 150 subscriptions @$100 = $1500

July: 150 subscriptions @$100 = $1500

August: 150 subscriptions @$100 = $1500

September: 150 subscriptions @$100 = $1500

October: 150 subscriptions @$100 = $1500

November: 15 subscriptions @$100 = $150

December: 15 subscriptions @$100 = $150

TOTAL Annual revenue = $12,800

Average Monthly revenue = $1066

So there are a couple of fundamental questions that need to be considered here. Not just for your compensation planning but also for your whole go-to-market model:

-

At what point does the account move from the person who won the business to account management?

-

How do you measure the value of the sale from a commission point of view?

These questions are difficult to answer. The sale was worth $12,800 in the first year. However, it could be worth considerably more if the startup secures funding. If they don't, they could burn through the last of their runway, meaning the sales is worth $0.

So the first big question that needs to be addressed is how can a sales organization place a value on the sale so they can accurately calculate commission?

Secondly, we need to acknowledge that a fundamental part of the subscription model is customer retention. Yes, your sales reps work hard to win your business. They deserve their sales compensation for their good work.

However, an account executive or manager will take over from there to ensure the business doesn't churn. This job makes a significant contribution to revenue too. So how can your sales compensation plans account for this?

Design challenge #2. for sales commission structures

The second big challenge we need to think about is the customer lifetime value (CLV). This concept is another metric that is popular in the SaaS and startup world.

It's crucial for subscription businesses because it measures the amount of revenue each customer generates during their entire relationship with your business.

Let's use our example of the tech healthcare startup again. After one year of business, they fail to get funding and closed down on December 31st.

So, we know that their total revenue generated was $12,000. That's their CLV.

But what if they somehow kept going? And five years later, they were still going strong, with a team of 1,000 generating $100,000 a month for your business. Their CLV would be totally different.

So how does your commission plan handle these scenarios? You can't know the CLV until your business arrangement has finished. You certainly can't ask your reps to accept a sales commission structure that asks them to wait half a decade while you work out their commission.

When is the right time to payout commission?

It really depends on your business model. However, the second commission plan design challenge here is deciding whether to split sales compensations.

The Account process: Should you split sales commission?

The big question here is whether you should split sales commission or not. To answer this question, let's take a look at the Account Process.

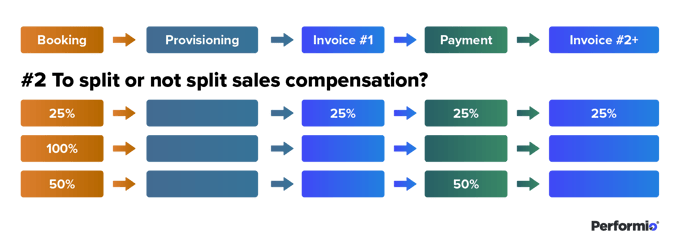

As you can see from the diagram, the Account Process has five initial steps.

-

Booking

-

Provisioning

-

Invoice #1

-

Payment

-

Invoice #2

Some companies favor a commission plan that pays out 25 percent chunks over the Account Process.

-

The first 25 percent when the sale happens.

-

The second 25 percent when you send the first invoice.

-

Another 25 percent when you receive payment.

-

And the final 25 percent when you send the second invoice.

Most companies, however, use one of two approaches:

A) Payout 100% of the sales commission upfront, with some stipulations.

B) Payout 50% upfront, with the remaining 50% coming after provisioning or when payment has been received.

Again, there is no right or wrong way. It largely depends on your particular business model or your preference about how you want to split commissions.

Let's explore the pros and cons of each approach

Pros and cons of an upfront payment commission plan

Sales commission plans that pay 100% upfront have some advantages and disadvantages sales leaders need to consider.

PROS:

-

Calculating sales commissions upfront is straightforward, provided you can accurately forecast total contract values. Sales managers can easily set a sales quota for each team or rep, and reps can easily understand the commission plan.

-

Upfront payments affect sales behaviors. Reps are incentivized to close deals today — rather than down the line — because they receive the full commission early. This commission model can shorten the sales cycle.

-

An upfront commission plan can lead to a more effective sales process because reps are incentivized to win business with longer commitment periods.

CONS:

-

Once your sales reps have received their commission, they have less incentive to engage with customers. This situation can lead to customer attrition, which can destroy your revenue targets.

-

If customers break contracts or cancel their subscriptions, you need to claw back sales commissions.

-

It creates a disconnect between accounts billable and commissions. In effect, you are paying your sales reps with money you've yet to receive. Sales and finance are on different pages.

Pros and cons of an over time payment commission plan

A sales commission structure that pays your sales team over time based on recurring revenue also has some advantages and disadvantages.

PROS:

-

Sales teams are paid commissions based on received revenue. If users churn or cancel their agreements, these sales compensation plans don't involve complex clawback on paid-out commissions.

-

It provides an incentive for your sales team to keep customer churn as low as possible.

-

It leads to tighter alignment between the sales and finance departments.

CONS:

-

Accurate commissions can be difficult to track

-

Top sales talent can become less motivated with a commission plan that takes a lot of time to pay out.

-

Newer reps will be over reliant on the base pay as they wait to build up enough recurring revenue draws

To recap, the two big questions we need to answer are:

-

How do you measure the value of a sale?

-

Should you split sales commissions or not?

Let's dig into an example to explore further.

Sales commission structure example

We've explained the:

-

two fundamental design issues with a commission plan

-

how subscription sales models like MRR and ARR work

-

why CLV and customer retention are important

Now, it's time to put it all together with an example that should highlight how to build a sales commission structure that works for your sales reps and your business.

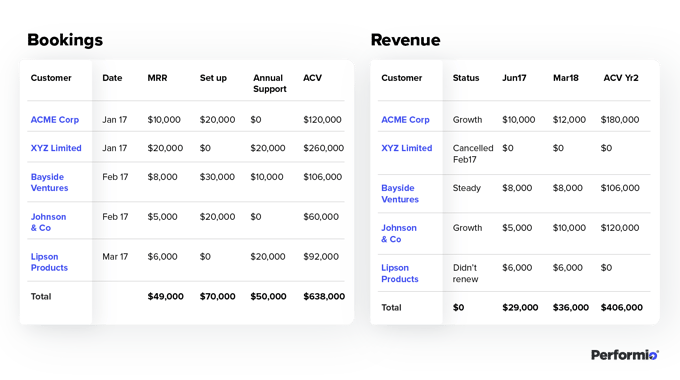

Let's say you have an account executive. They've made some Q1 sales.

Per the graphic above, they have five clients. Each customer pays:

-

A monthly subscription (MRR)

-

Some pay a one-off setup fee

-

Some pay for annual support

We can arrive at an actual contract value (ACV) by adding up the respective contracts. The total sales came to $638,000.

Of course, these figures are a projection. As we moved through the months, we can see that the closed deals a company sells don't always work out.

By the next year, one of the businesses had grown. However, one canceled after a month, and the other did not renew. When we look at the year two ACV, it's $406,00, a full $232,000 lower than expected.

This problem gets at the heart of why you need a commission plan that reflects the reality of SaaS business models.

If your sales commission structure pays your sales reps 100% at the start, you're in trouble. If the typical sales commission percentage is between 20% and 30% of gross margin, a canceled contract means you have to claw back that money somehow.

Making advance payments to your sales reps can go badly wrong if your user churn is high. Adjusting the rep's commission is far easier with a dynamic sales commission plan.

So, there are a lot of situations where these issues can get very complex.

Leading SaaS Sales Compensation Plans: Attainment Versus Commission

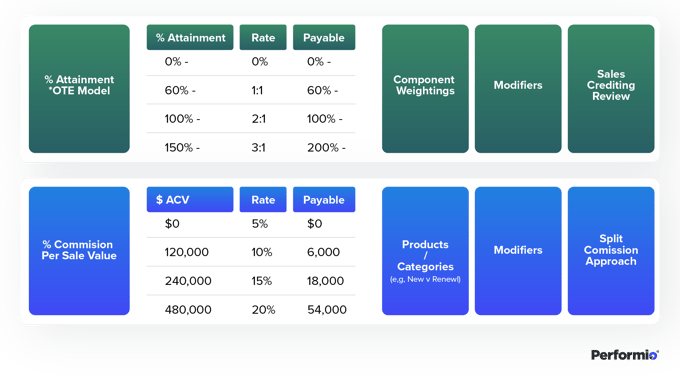

We see two popular types of sales commission models in the market.

-

There is the percentage of attainment, percentage of goal or target, times, and on-target commission (OTC) or on-target earnings (OTE).

-

Then you have your classic percentage commission per sale value type plan, for instance, 20 percent of the actual contract value (ACV).

OTE model

The on-target earnings (OTE) model is a tried and true component of many commission plans. If you look at the graphic above, the model sets out a sales quota and only pays out when sales reps earn 60% of their target.

Additionally, in the example above, high sales performance is rewarded when sales reps go over their target:

-

Over 100% is paid at an x2 commission rate

-

Over 100% is paid an x3 commission rate

The pay curve is already baked in. It's a robust way for sales organizations to reward top performers.

OTE model benefits

A benefit of the on-target earnings (OTE) model is you can slice up your own target earnings into different components. For example, you might say we're going to pay salespeople on their bookings as one component, but we're also going to look at the revenue billed over the course of the year.

So we'll try and balance the upfront booking versus the ongoing revenue by slicing their OTEs into two buckets.

One of the benefits of the OTE model is how you actually measure the sale based on things like contract lengths. We're going to give you, the salesperson, a multiplier based on the length of the contract term.

Percentage commission per sale model

A percentage commission per sale model is another effective approach. It's a bit more dynamic because you can look at different rates per product.

For example, higher-margin products might have a higher accelerator rate to help incentive your sales team.

Alternatively, you can have categories like new vs. renewal. A typical commission plan could have a rate of 10% for new business, with a lower rate of 1% to 2% for renewals. And then using modifiers again around the gross margin, attainment might modify the commission up or down.

Another payment variation to consider is you say to your sales team, "We're going to pay you that $10,000 on a particular deal, but we're going to pay 50 percent upon the booking and 50 percent at the first invoice."

Or maybe 50 percent at the end of the first year of the contract. The sales commission structure you choose will depend on the particular things that are important to your business.

However, as part of this compensation plan, you will claw back the commission if the client cancels their deal. So, if the agreement referenced above cancels, you can claw back $10,900.

The one issue with this kind of commission structure is that if one of your sales team only books a few closed deals per year, that clawback could bring them into negative territory, where they owe you a sales commission.

If your sales reps typically win a small number of deals per year, this scenario is something you need to consider. Situations like this are bad for motivation. Suppose this is a potential scenario for your business. In that case, you need to think about the 50 percent upfront and the 50 percent at some point farther down the cycle or even back-end the deal more to avoid this horrible scenario.

True-ups for actuals

Another idea to consider is true-ups for actuals. These are payments made after the deal that reflect the difference between the original purchase point and the actual revenue your sales bring in.

With this model, you can pay 15% upfront. Then, as the months go by, you can consult your Enterprise Resource Planning (ERP) system and pay a further sales commission based on what the deal is worth at defined intervals. This commission model is dynamic.

This is quite a sophisticated model. Some people might argue it is the best practice. Again, it depends on your objectives, how sophisticated your systems are, and whether you can track the annual contract value – whatever the value measurement is over time for that particular customer and order.

Key challenges with commission per sale models

The great thing about commission per sale models is that you can say to your sales team that they are, for example, going to get 10% of sale value either:

a) paid upfront

b) split 50-50.

It's very simple for sales organizations and their reps to work out.

However, the same can't be said of the OTE model. It's more difficult to predict and forecast with accuracy.

The downside of the commission per sale model is what we tend to see if there is a vast universe of possibilities, and most companies have more than one objective or more than one metric. You start to see multiple ways of earning a commission. So you get this complexity that builds out quickly.

How Do You Measure the Success of Your SaaS Sales Comp Plan?

The type of sales commission plan that you use should ultimately be the one that works best for achieving your business objectives. Each sales compensation plan will have advantages and disadvantages.

Some common business objectives you can have are:

-

Revenue generation

-

Building profitable professional services

-

Driving rapid growth

-

Aligning sales reps to customer success

-

Alignment of costs to revenue in line

-

Promote teamwork between account executives and account managers

Some of these objectives can actually be in conflict with each other. So, while one sales commission plan will help you reach your objective, it could be at the cost of other goals. As such, you need to consider how each sales compensation plan affects your business and your reps.

How to decide on your sales commission structure

Clarity is the most crucial element in deciding on your sales commission structure. This fact is true of any compensation plan, whether it's for subscription-based models or one-off sales.

You need to communicate your objectives to each sales rep and other stakeholders and ensure you have buy-in. If you want everyone to pull together in the same direction, you need everyone to be motivated by the same metrics.

In the past, many sales organizations were very fractured. Their marketing, customer success, and sales teams existed in silos. SaaS leaders have long recognized how these different groups were often led by conflicting metrics or objectives.

One popular solution to tying groups together is by focusing these different teams on, for example, revenue. That could mean finding new business and reducing the churn rate.

If part of a SaaS sales rep's variable pay depends on retention, they will be incentivized to reduce churn by forging good relationships with existing customers. Additionally, they will want marketing to reflect their product or service accurately. Greater awareness of the customer journey means that things should be smooth when a sales rep hands over to the account manager.

Choosing the right sales commission structures for your sales reps

As you can see, there are a lot of different sales commission structures. Each of them can be useful depending on the product or service you sell. Additionally, each can help motivate your sales executives or top performers in slightly different ways.

For SaaS businesses, reducing churn is essential. If your customer churn is high, your revenue will suffer, even if you add new business. Because retention is important, each sales rep must be motivated to think long-term. That might mean spending more time on customer education or prospecting to ensure that the product is a good fit for a business and they will stick around.

What motivates your sales team

Each sales rep will have different things that motivate them. Some common motivations will be money and competition. While others will be driven by secondary motivations, too, like pride in their job, helping a business grow, and even solving client problems.

But, it's safe to say that base salary and incentive pay (also known as variable pay) are the primary motivators of reps regardless of sales position. A strong sales commission plan will go a long way towards getting the best out of each staff member.

How pay mix influences behaviors

The pay mix you choose will influence the behavior of each rep.

Commission heavy pay mixes will attract a specific type of sales rep who is more aggressive in pursuing their sales goals. While these individuals can help close deals as they exceed their sales targets, they aren't always the most focused on the long term.

On the other hand, a base salary-heavy commission plan will attract a different type of sales rep. Because variable pay makes up a lower portion of their salary, they might not pursue sales quite as aggressively as other reps. However, they can take a little more time to pick the type of prospects they engage carefully. A high base pay rate can allow reps to spend more time on research and admin, which can be an advantage.

For SaaS businesses, a sales compensation plan that is heavily focused on first-time sales can be good for growth. However, this acquisition model can also lead to high customer churn because of a less strict attitude towards customer-product fit.

A tiered commission structure can motivate your sales reps to close larger and more long-lasting deals rather than lots of smaller deals.

Again, which option works for you largely depends on your product or service and your business objectives.

Let Performio help you design sales compensation plans for your recurring revenue business model

Performio can help you design a sales compensation solution that will smooth over all your rough spots, whatever model of payment you choose, be it attainment or compensation value per contract.

If you are serious about creating a high-performance culture in your company, Performio offers a tailored demo of our sales commission software. We invite you to give our outstanding product a try.